-----------------

# PyCurve - Python Yield Curve Toolkit

-----------------

## What is it ?

*PyCurve* is a Python package that provides to user high level

yield curve usefull tool. For example you can istanciate a Curve

and get a d_rate, a discount factor, even forward d_rate given multiple

methodology from Linear Interpolation to parametrization methods

as Nelson Siegel or Bjork-Christenssen. PyCurve is also able to provide

solutions in order to build yield curve or price Interest rates derivatives

via Vasicek or Hull and White.

-----------------

## Features

Below this is the features that this package tackle :

- Curve Smoothing:

- Create Curve Object with two numpy array (t,rt)

- Linear interpolation given a Curve

- Cubic interpolation given a Curve

- Nelson Siegel and Svensson model creation and components plotting

- Nelson Siegel and Svensson calibration given a Curve

- Bjork Christensen and Augmented (6 factors) model creation and components plotting

- Stochastic Modelling:

- Vasicek Model Simulation

- Hull and White one factor Model Simulation

-----------------

## How to install

From pypi

```sh

pip install PyCurve

```

From pypi specific version

```sh

pip install PyCurve==0.0.5

```

From Git

```sh

git clone https://github.com/ahgperrin/PyCurve.git

pip install -e .

```

# Objects

## Curve Object

This object consists in a simple yield curve encapsulation. This object is used by others class to encapsulate results

or in order to directly create a curve with data obbserved in the market.

| Attributes | Type | Description |

| :----------:|:--------| :-------------------------------------------|

| rt | Private | Interest rates as float in a numpy.ndarray |

| t | Private | Time as float or int in a numpy.ndarray |

| Methods | Type | Description | Return

| :------------------:|:--------| :-------------------------| :----------|

| get_rate | Public | rt getter | _rt |

| get_time | Public | rt getter | _t |

| set_rate | Public | rt getter | None |

| set_time | Public | rt getter | None |

| is_valid_attr(attr) | Private | Check attributes validity | attribute |

| plot_curve() | Public | Plot Yield curve | None |

### Example

```sh

from PyCurve.curve import Curve

time = np.array([0.25, 0.5, 0.75, 1., 2.,

3., 4., 5., 10., 15.,

20.,25.,30.])

rate = np.array([-0.63171, -0.650322, -0.664493, -0.674608, -0.681294,

-0.647593, -0.587828, -0.51251, -0.101804, 0.182851,

0.32962,0.392117, 0.412151])

curve = Curve(rate,time)

curve.plot_curve()

print(curve.get_rate)

print(curve.get_time)

```

```yaml

[ 0.25 0.5 0.75 1. 2. 3. 4. 5. 10. 15. 20. 25.

30. ]

[-0.63171 -0.650322 -0.664493 -0.674608 -0.681294 -0.647593 -0.587828

-0.51251 -0.101804 0.182851 0.32962 0.392117 0.412151]

```

## Simulation Object

This object consists in a simple simulation encapsulation. This object is used by others class to encapsulate results

of monte carlo simulation. This Object has build in method that could perform the conversion from a simulation to

a yield curve or to a discount factor curve.

| Attributes | Type | Description |

| :----------:|:--------| :------------------------------------------------|

| sim | Private | Simulated paths matrix numpy.ndarray |

| dt | Private | delta_time as float or int in a numpy.ndarray |

| Methods | Type | Description & Params | Return |

|-------------------------------|---------|-----------------------------------------------------------------------------|--------------|

| get_sim | Public | sim getter | _rt |

| get_nb_sim | Public | nb_sim getter | sim.shape[0] |

| get_steps | Public | steps getter | sim.shape[1] |

| get_dt | Public | dt getter | _dt |

| is_valid_attr(attr) | Private | Check attributes validity | attribute |

| yield_curve() | Public | Create a yield curve from simulated paths | Curve |

| discount_factor() | Public | Convert d_rate simulation to discount factor | np.ndarray |

| plot_discount_curve(average) | Public | Plot discount factor (average :bool False plot all paths True Plot estimate)| None |

| plot_simulation() | Public | Plot Yield curve | None |

| plot_yield_curve() | Public | Plot Yield curve | None |

| plot_model() | Public | Plot Yield curve | None |

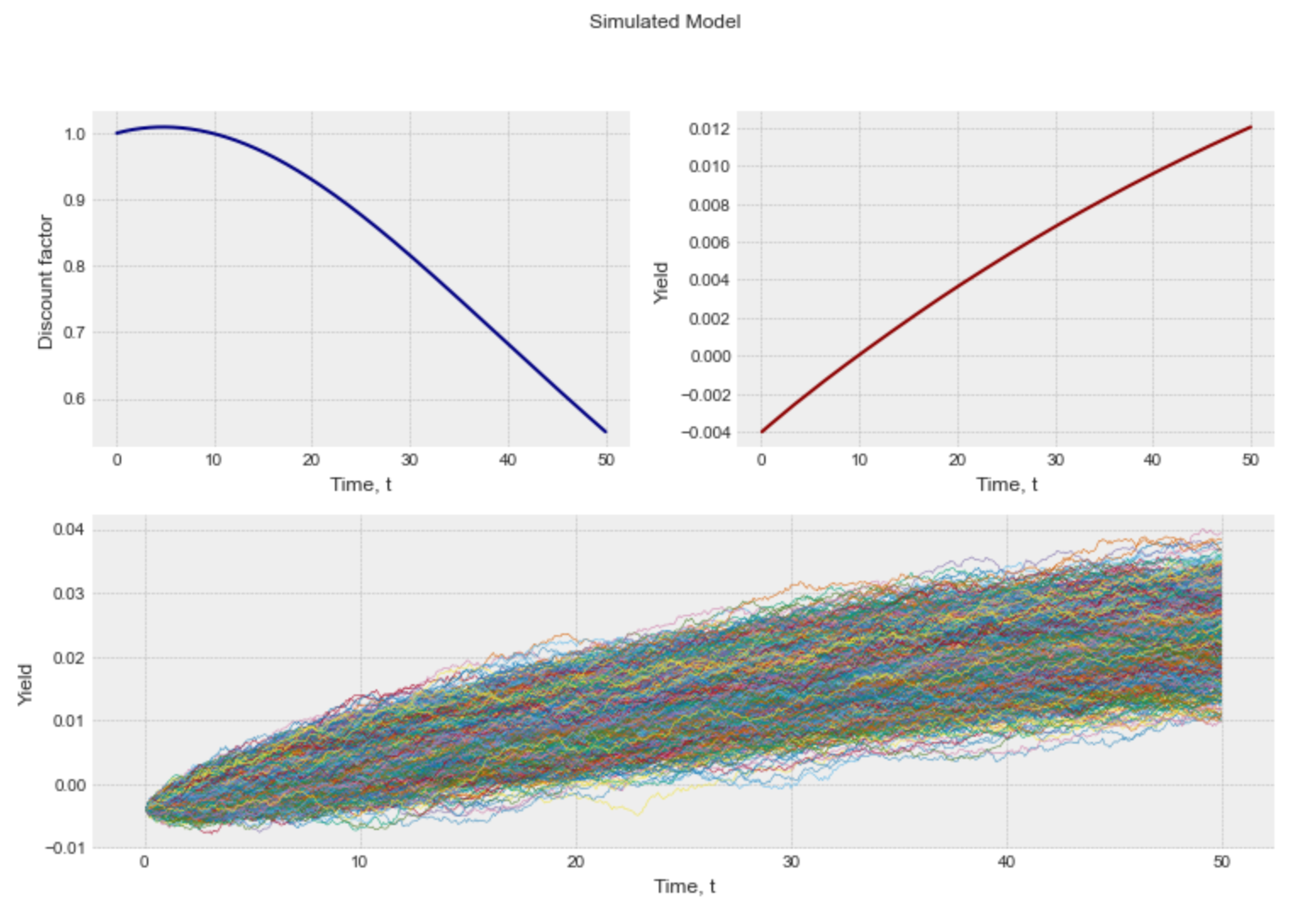

### Example

Using Vasicek to Simulate

```sh

from PyCurve.vasicek import Vasicek

vasicek_model = Vasicek(0.02, 0.04, 0.001, -0.004, 50, 30 / 365)

simulation = vasicek_model.simulate_paths(2000) #Return a Simulation and then we can apply Simulation Methods

simulation.plot_yield_curve()

```

```sh

simulation.plot_model()

```

-----------------

# Yield Curve Construction Tools

This section is the description with examples of what you can do with this package

Please note that for all the examples in this section curve is referring to the curve below

you can see example regarding Curve Object in the dedicated section.

```sh

from PyCurve import Curve

time = np.array([0.25, 0.5, 0.75, 1., 2.,

3., 4., 5., 10., 15.,

20.,25.,30.])

d_rate = np.array([-0.63171, -0.650322, -0.664493, -0.674608, -0.681294,

-0.647593, -0.587828, -0.51251, -0.101804, 0.182851,

0.32962,0.392117, 0.412151])

curve = Curve(time,d_rate)

```

## linear

Interpolate any d_rate from a yield curve using linear interpolation. THis module is build using scipy.interpolate

| Attributes | Type | Description |

| :----------:|:--------| :------------------------------------------------ |

| curve | Private | Curve Object to be intepolated |

| func_rate | Private | interp1d Object used to interpolate |

| Methods | Type | Description & Params | Return |

|-------------------------------|---------|-----------------------------------------------------------------------------|--------------|

| d_rate(t) | Public | d_rate interpolation t: float, array,int | float |

| df_t(t) | Public | discount factor interpolation t: float, array,int | float |

| forward(t1,t2) | Public | forward d_rate between t1 and t2 t1,t2: float, array,int | float |

| create_curve(t_array) | Public | create a Curve object for t values t:array | Curve |

| is_valid_attr(attr) | Private | Check attributes validity | attribute |

### Example

```sh

from PyCurve.linear import LinearCurve

linear_curve = LinearCurve(curve)

print("7.5-year d_rate : "+str(linear_curve.d_rate(7.5)))

print("7.5-year discount d_rate : "+str(linear_curve.df_t(7.5)))

print("Forward d_rate between 7.5 and 12.5 years : "+str(linear_curve.forward(7.5,12.5)))

```

```yaml

7.5-year d_rate : -0.307157

7.5-year discount d_rate : 1.0233404498400862

Forward d_rate between 7.5 and 12.5 years : 0.5620442499999999

```

## cubic

Interpolate any d_rate from a yield curve using linear interpolation. THis module is build using scipy.interpolate

| Attributes | Type | Description |

| :----------:|:--------| :------------------------------------------------ |

| curve | Private | Curve Object to be intepolated |

| func_rate | Private | PPoly Object used to interpolate |

| Methods | Type | Description & Params | Return |

|-------------------------------|---------|-----------------------------------------------------------------------------|--------------|

| d_rate(t) | Public | d_rate interpolation t: float, array,int | float |

| df_t(t) | Public | discount factor interpolation t: float, array,int | float |

| forward(t1,t2) | Public | forward d_rate between t1 and t2 t1,t2: float, array,int | float |

| create_curve(t_array) | Public | create a Curve object for t values t:array | Curve |

| is_valid_attr(attr) | Private | Check attributes validity | attribute |

### Example

```sh

from PyCurve.cubic import CubicCurve

cubic_curve = CubicCurve(curve)

print("10-year d_rate : "+str(cubic_curve.d_rate(7.5)))

print("10-year discount d_rate : "+str(cubic_curve.df_t(7.5)))

print("Forward d_rate between 10 and 20 years : "+str(cubic_curve.forward(7.5,12.5)))

```

```yaml

10-year d_rate : -0.3036366057950627

10-year discount d_rate : 1.0230694659050514

Forward d_rate between 10 and 20 years : 0.6078001168478189

```

## Nelson-Siegel

| Attributes | Type | Description |

| :----------:|:--------| :------------------------------------------------ |

| beta0 | Private | Model Coefficient Beta0 |

| beta1 | Private | Model Coefficient Beta1 |

| beta2 | Private | Model Coefficient Beta2 |

| tau | Private | Model Coefficient tau |

| attr_list | Private | Coefficient list |

| Methods | Type | Description & Params | Return |

|------------------------------|---------|-----------------------------------------------------------------------------|-------------------|

| get_attr(str(attr)) | Public | attributes getter | attribute |

| set_attr(attr) | Public | attributes setter | None |

| print_model() | Public | print the Ns model set | None |

| _calibration_func(x,curve) | Private | Private method used for calibration method | float:sqr_err |

| _is_positive_attr(attr) | Private | Check attributes positivity (beta0 and tau | attribute |

| _is_valid_curve(curve) | Private | Check if the curve given for calibration is a Curve Object | Curve |

| _print_fitting() | Private | Print the result after the calibration | None |

| calibrate(curve) | Public | Minimize _calibration_func(x,curve) | sco.OptimizeResult|

| _time_decay(t) | Private | Compute the time decay part of the model t (float or array) | float,array |

| _hump(t) | Private | Compute the hump part of the model given t (float or array) | float,array |

| d_rate(t) | Public | Get d_rate from the model for a given time t (float or array) | float,array |

| plot_calibrated() | Public | Plot Model curve against Curve | None |

| plot_model_params() | Public | Plot Model parameters | None |

| plot_model() | Public | Plot Model Components | None |

| df_t(t) | Public | Get the discount factor from the model for a given time t (float or array) | float,array |

| cdf_t(t) | Public | Get the continuous df from the model for a given time t (float or array) | float,array |

| forward_rate(t1,t2) | Public | Get the forward d_rate for a given time t1,t2 (float or array) | float,array |

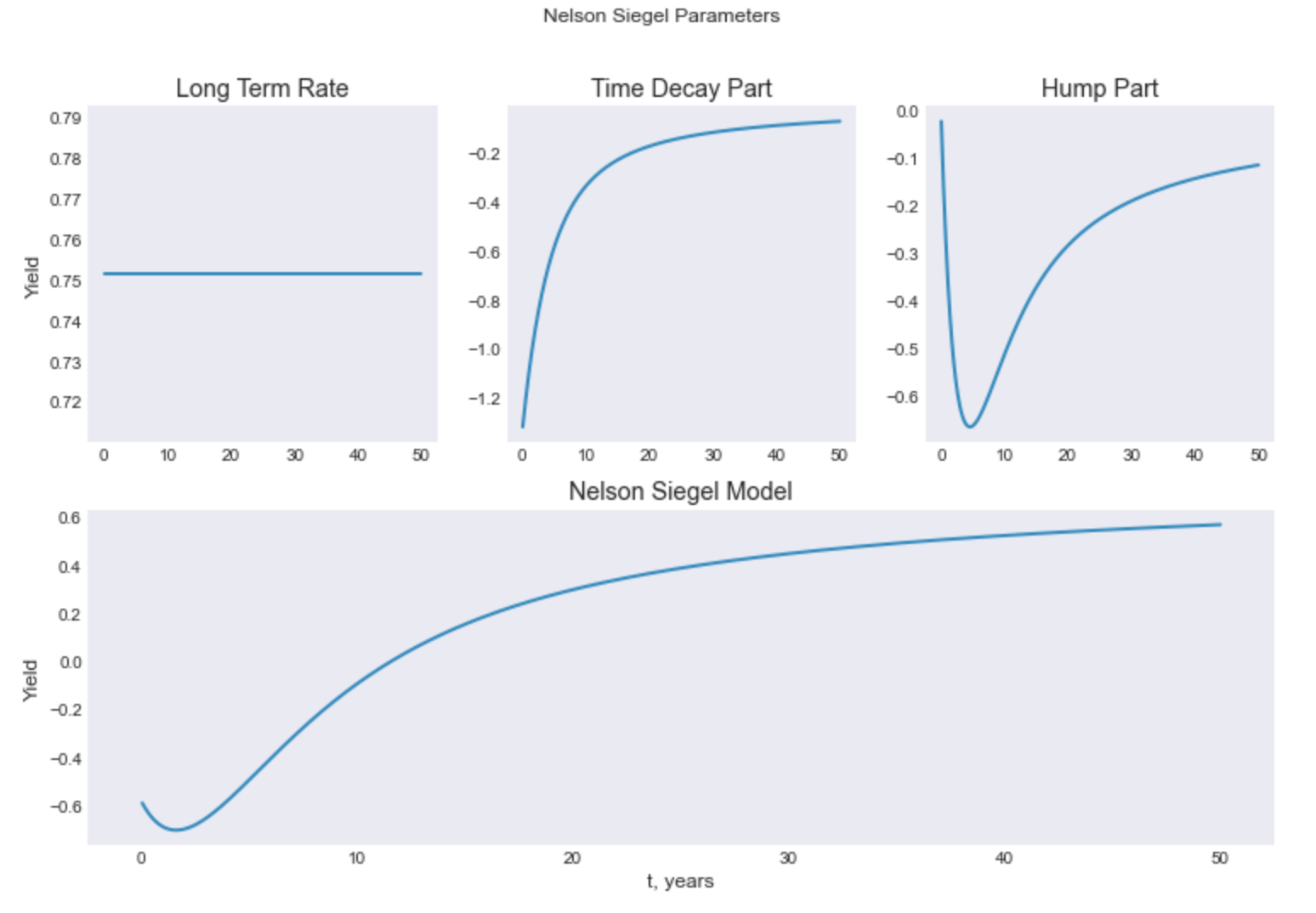

### Example

Creation of a model and calibration

```sh

from PyCurve.nelson_siegel import NelsonSiegel

ns = NelsonSiegel(0.3,0.4,12,1)

ns.calibrate(curve)

```

```yaml

Nelson Siegel Model

============================

beta0 = 0.751506062319988

beta1 = -1.3304971868997248

beta2 = -2.2203178895179176

tau = 2.5493056203052005

____________________________

============================

Calibration Results

============================

CONVERGENCE: NORM_OF_PROJECTED_GRADIENT_<=_PGTOL

Mean Squared Error 0.0042367306926415285

Number of Iterations 20

____________________________

Out[19]:

fun: 0.0042367306926415285

hess_inv: <4x4 LbfgsInvHessProduct with dtype=float64>

jac: array([-2.40077054e-06, 9.51322360e-07, -2.33927462e-07, 7.97278914e-07])

message: 'CONVERGENCE: NORM_OF_PROJECTED_GRADIENT_<=_PGTOL'

nfev: 105

nit: 20

njev: 21

status: 0

success: True

x: array([ 0.75150606, -1.33049719, -2.22031789, 2.54930562])

```

Plotting and analyse

```sh

ns.plot_calibrated()

```

```sh

ns.plot_model_params()

```

```sh

ns.plot_model()

```

## nelson-siegel-svensson

| Attributes | Type | Description |

| :----------:|:--------| :------------------------------------------------ |

| beta0 | Private | Model Coefficient Beta0 |

| beta1 | Private | Model Coefficient Beta1 |

| beta2 | Private | Model Coefficient Beta2 |

| beta3 | Private | Model Coefficient Beta3 |

| tau | Private | Model Coefficient tau |

| tau2 | Private | Model Coefficient tau2 |

| attr_list | Private | Coefficient list |

| Methods | Type | Description & Params | Return |

|------------------------------|---------|-----------------------------------------------------------------------------|-------------------|

| get_attr(str(attr)) | Public | attributes getter | attribute |

| set_attr(attr) | Public | attributes setter | None |

| print_model() | Public | print the Ns model set | None |

| _calibration_func(x,curve) | Private | Private method used for calibration method | float:sqr_err |

| _is_positive_attr(attr) | Private | Check attributes positivity (beta0 and tau | attribute |

| _is_valid_curve(curve) | Private | Check if the curve given for calibration is a Curve Object | Curve |

| _print_fitting() | Private | Print the result after the calibration | None |

| calibrate(curve) | Public | Minimize _calibration_func(x,curve) | sco.OptimizeResult|

| _time_decay(t) | Private | Compute the time decay part of the model t (float or array) | float,array |

| _hump(t) | Private | Compute the hump part of the model given t (float or array) | float,array |

| _second_hump(t) | Private | Compute the second hump part of the model given t (float or array) | float,array |

| d_rate(t) | Public | Get d_rate from the model for a given time t (float or array) | float,array |

| plot_calibrated() | Public | Plot Model curve against Curve | None |

| plot_model_params() | Public | Plot Model parameters | None |

| plot_model() | Public | Plot Model Components | None |

| df_t(t) | Public | Get the discount factor from the model for a given time t (float or array) | float,array |

| cdf_t(t) | Public | Get the continuous df from the model for a given time t (float or array) | float,array |

| forward_rate(t1,t2) | Public | Get the forward d_rate for a given time t1,t2 (float or array) | float,array |

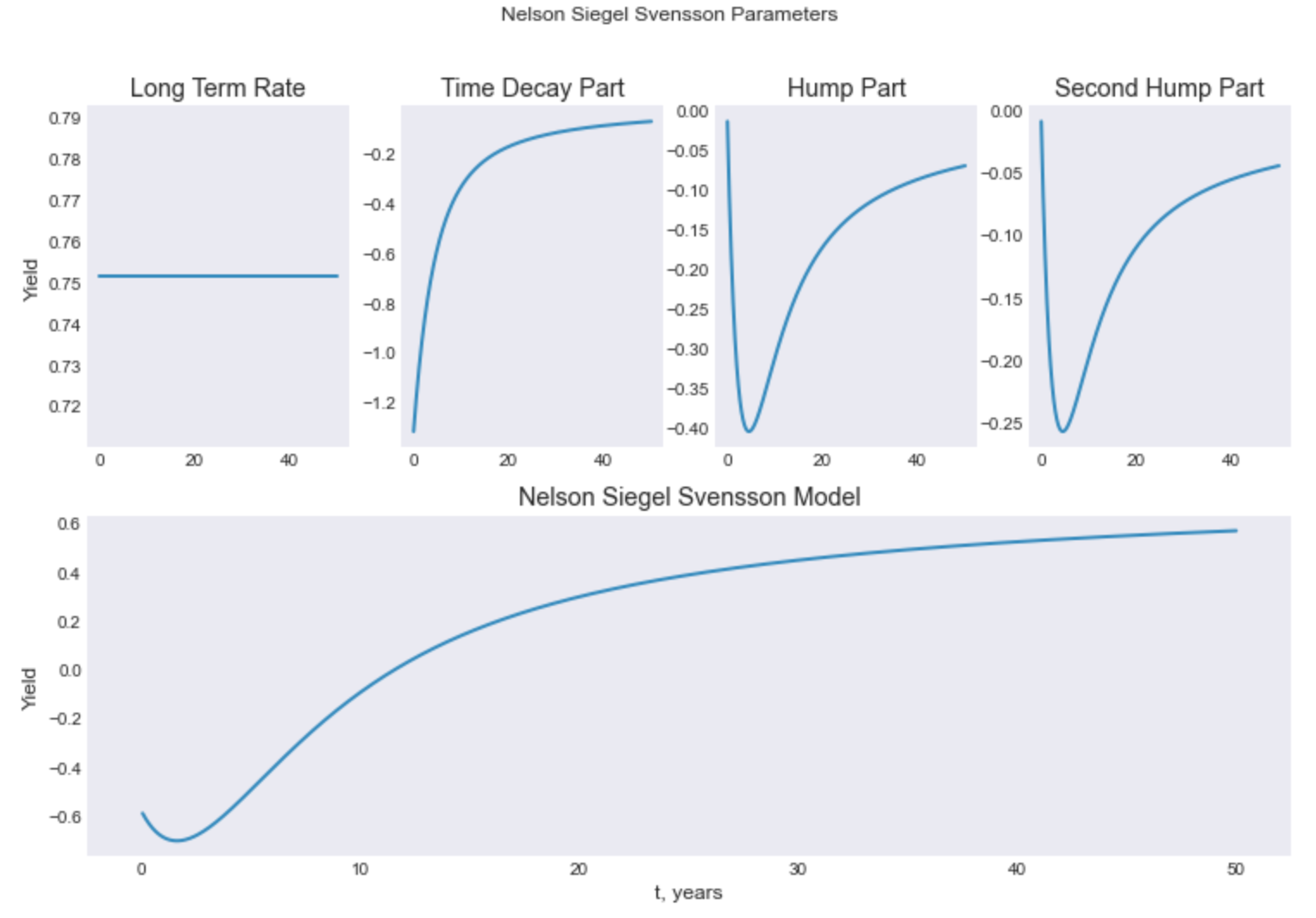

### Example

Creation of a model and calibration

```sh

from PyCurve.svensson_nelson_siegel import NelsonSiegelAugmented

nss = NelsonSiegelAugmented(0.3,0.4,12,12,1,1)

nss.calibrate(curve)

```

```yaml

Augmented Nelson Siegel Model

============================

beta0 = 0.7515069899513361

beta1 = -1.3304984652740972

beta2 = -1.3582175270153745

beta3 = -0.8621237370245594

tau = 2.5492666085730384

tau2 = 2.5493745447283485

____________________________

============================

Calibration Results

============================

CONVERGENCE: NORM_OF_PROJECTED_GRADIENT_<=_PGTOL

Mean Squared Error 0.004236730702075479

Number of Iterations 31

____________________________

Out[31]:

fun: 0.004236730702075479

hess_inv: <6x6 LbfgsInvHessProduct with dtype=float64>

jac: array([-8.70041881e-06, -3.48375844e-06, -1.71824361e-06, -1.71911096e-06,

1.00535900e-06, 3.23178986e-07])

message: 'CONVERGENCE: NORM_OF_PROJECTED_GRADIENT_<=_PGTOL'

nfev: 245

nit: 31

njev: 35

status: 0

success: True

x: array([ 0.75150699, -1.33049847, -1.35821753, -0.86212374, 2.54926661,

2.54937454])

```

Plotting possibilities are the same as for the Nelson-Siegel model for example

```sh

nss.plot_model_params()

```

## bjork-christensen

| Attributes | Type | Description |

| :----------:|:--------| :------------------------------------------------ |

| beta0 | Private | Model Coefficient Beta0 |

| beta1 | Private | Model Coefficient Beta1 |

| beta2 | Private | Model Coefficient Beta2 |

| beta3 | Private | Model Coefficient Beta3 |

| tau | Private | Model Coefficient tau |

| attr_list | Private | Coefficient list |

| Methods | Type | Description & Params | Return |

|------------------------------|---------|-----------------------------------------------------------------------------|-------------------|

| get_attr(str(attr)) | Public | attributes getter | attribute |

| set_attr(attr) | Public | attributes setter | None |

| print_model() | Public | print the Ns model set | None |

| _calibration_func(x,curve) | Private | Private method used for calibration method | float:sqr_err |

| _is_positive_attr(attr) | Private | Check attributes positivity (beta0 and tau | attribute |

| _is_valid_curve(curve) | Private | Check if the curve given for calibration is a Curve Object | Curve |

| _print_fitting() | Private | Print the result after the calibration | None |

| calibrate(curve) | Public | Minimize _calibration_func(x,curve) | sco.OptimizeResult|

| _time_decay(t) | Private | Compute the time decay part of the model t (float or array) | float,array |

| _hump(t) | Private | Compute the hump part of the model given t (float or array) | float,array |

| _second_hump(t) | Private | Compute the second hump part of the model given t (float or array) | float,array |

| d_rate(t) | Public | Get d_rate from the model for a given time t (float or array) | float,array |

| plot_calibrated() | Public | Plot Model curve against Curve | None |

| plot_model_params() | Public | Plot Model parameters | None |

| plot_model() | Public | Plot Model Components | None |

| df_t(t) | Public | Get the discount factor from the model for a given time t (float or array) | float,array |

| cdf_t(t) | Public | Get the continuous df from the model for a given time t (float or array) | float,array |

| forward_rate(t1,t2) | Public | Get the forward d_rate for a given time t1,t2 (float or array) | float,array |

### Example

Creation of a model and calibration

```sh

from PyCurve.bjork_christensen import BjorkChristensen

bjc = BjorkChristensen(0.3,0.4,12,12,1)

bjc.calibrate(curve)

```

```yaml

Bjork & Christensen Model

============================

beta0 = 0.7241026361747042

beta1 = 1.2630412759302045

beta2 = -4.075775255903699

beta3 = -2.61578890758314

tau = 2.0454907238894267

____________________________

============================

Calibration Results

============================

CONVERGENCE: NORM_OF_PROJECTED_GRADIENT_<=_PGTOL

Mean Squared Error 0.002575936865445517

Number of Iterations 37

____________________________

Out[36]:

fun: 0.002575936865445517

hess_inv: <5x5 LbfgsInvHessProduct with dtype=float64>

jac: array([-1.34584183e-06, 7.22165387e-07, -9.63335320e-07, 1.34501786e-06,

4.57750160e-07])

message: 'CONVERGENCE: NORM_OF_PROJECTED_GRADIENT_<=_PGTOL'

nfev: 252

nit: 37

njev: 42

status: 0

success: True

x: array([ 0.72410264, 1.26304128, -4.07577526, -2.61578891, 2.04549072])

```

Plotting possibilities are the same as for the Nelson-Siegel model for example

```sh

bjc.plot_model()

```

## bjork-christensen-augmented

| Attributes | Type | Description |

| :----------:|:--------| :------------------------------------------------ |

| beta0 | Private | Model Coefficient Beta0 |

| beta1 | Private | Model Coefficient Beta1 |

| beta2 | Private | Model Coefficient Beta2 |

| beta3 | Private | Model Coefficient Beta3 |

| beta4 | Private | Model Coefficient Beta4 |

| tau | Private | Model Coefficient tau |

| attr_list | Private | Coefficient list |

| Methods | Type | Description & Params | Return |

|------------------------------|---------|-----------------------------------------------------------------------------|-------------------|

| get_attr(str(attr)) | Public | attributes getter | attribute |

| set_attr(attr) | Public | attributes setter | None |

| print_model() | Public | print the Ns model set | None |

| _calibration_func(x,curve) | Private | Private method used for calibration method | float:sqr_err |

| _is_positive_attr(attr) | Private | Check attributes positivity (beta0 and tau | attribute |

| _is_valid_curve(curve) | Private | Check if the curve given for calibration is a Curve Object | Curve |

| _print_fitting() | Private | Print the result after the calibration | None |

| calibrate(curve) | Public | Minimize _calibration_func(x,curve) | sco.OptimizeResult|

| _time_decay(t) | Private | Compute the time decay part of the model t (float or array) | float,array |

| _hump(t) | Private | Compute the hump part of the model given t (float or array) | float,array |

| _second_hump(t) | Private | Compute the second hump part of the model given t (float or array) | float,array |

| _third_hump(t) | Private | Compute the third hump part of the model given t (float or array) | float,array |

| d_rate(t) | Public | Get d_rate from the model for a given time t (float or array) | float,array |

| plot_calibrated() | Public | Plot Model curve against Curve | None |

| plot_model_params() | Public | Plot Model parameters | None |

| plot_model() | Public | Plot Model Components | None |

| df_t(t) | Public | Get the discount factor from the model for a given time t (float or array) | float,array |

| cdf_t(t) | Public | Get the continuous df from the model for a given time t (float or array) | float,array |

| forward_rate(t1,t2) | Public | Get the forward d_rate for a given time t1,t2 (float or array) | float,array |

### Example

Creation of a model and calibration

```sh

from PyCurve.bjork_christensen_augmented import BjorkChristensenAugmented

bjc_a = BjorkChristensenAugmented(0.3,0.4,12,12,12,1)

bjc_a.calibrate(curve)

```

```yaml

Bjork & Christensen Augmented Model

============================

beta0 = 1.5954945516202643

beta1 = -0.1362673420894012

beta2 = -1.921347491829477

beta3 = -3.100138400789165

beta4 = -0.2790540854856497

tau = 3.3831338085688625

____________________________

============================

Calibration Results

============================

CONVERGENCE: REL_REDUCTION_OF_F_<=_FACTR*EPSMCH

Mean Squared Error 4.6222147406189135e-05

Number of Iterations 45

____________________________

Out[39]:

fun: 4.6222147406189135e-05

hess_inv: <6x6 LbfgsInvHessProduct with dtype=float64>

jac: array([-3.13922277e-05, -1.14224797e-04, -3.47444433e-05, 2.07803821e-05,

7.91378953e-06, 6.50288949e-06])

message: 'CONVERGENCE: REL_REDUCTION_OF_F_<=_FACTR*EPSMCH'

nfev: 357

nit: 45

njev: 51

status: 0

success: True

x: array([ 1.59549455, -0.13626734, -1.92134749, -3.1001384 , -0.27905409,

3.38313381])

```

Plotting possibilities are the same as for the Nelson-Siegel model for example

```sh

bjc_a.plot_calibrated(curve)

```

# Stochastic Tools

## vasicek

| Attributes | Type | Description |

| :----------:|:--------| :------------------------------------------------ |

| alpha | Private | Model Coefficient alpha (mean reverting speed) |

| beta | Private | Model Coefficient Beta (long term mean) |

| sigma | Private | Short rate Volatility |

| rt | Private | Initial Short Rate |

| time | Params | Time in years |

| dt | Private | time for each period |

| steps | Private | calculated with dt & time as time/dt |

| Methods | Type | Description & Params | Return |

|------------------------------|---------|-------------------------------------------------------|-------------------|

| get_attr(str(attr)) | Public | attributes getter | attribute |

| sigma_part(n) | Private | compute n sigma part | float |

| mu_dt(rt) | Private | compute drift part | float |

| simulate_paths(n) | Public | Simulate n Short rate paths | np.ndarray |

| plot_calibrated(simul,curve) | Public | Plot yield curve against simulate curve | None |

```sh

time = np.array([0.25, 0.5, 0.75, 1., 2.,

3., 4., 5., 10., 15.,

20., 25., 30.])

rate = np.array([-0.0063171, -0.00650322, -0.00664493, -0.00674608, -0.00681294,

-0.00647593, -0.00587828, -0.0051251, -0.00101804, 0.00182851,

0.0032962, 0.0030092117, 0.00412151])

curve = Curve(time,rate)

vasicek_model = Vasicek(0.5, 0.0040, 0.001, -0.0067, 30, 1 / 365)

simulation = vasicek_model.simulate_paths(200)

vasicek_model.plot_calibrated(simulation,curve)

```

All the tools for graphing from simulation could be applied to vasicek simulation results.

## hull & white

| Attributes | Type | Description |

| :----------:|:--------| :------------------------------------------------ |

| alpha | Private | Model Coefficient alpha (mean reverting speed) |

| sigma | Private | Short rate Volatility |

| rt | Private | Initial Short Rate |

| time | Params | Time in years |

| dt | Private | time for each period |

| steps | Private | calculated with dt & time as time/dt |

| f_curve | Private | Curve : Initial instantaneous forward structure |

| method | Private | method used in order to interpolate f_curve |

| Methods | Type | Description & Params | Return |

|------------------------------|---------|------------------------------------------------------------|-------------------|

| get_attr(str(attr)) | Public | attributes getter | attribute |

| _is_valid_curve(curve) | Private | Check if the curve given for calibration is a Curve Object | Curve |

| sigma_part(n) | Private | compute n sigma part | float |

| interp_forward(t) | Private | interpolate forward curve for maturity t | float |

| theta_part(t) | Private | compute theta(t) | float |

| mu_dt(rt,t) | Private | compute drift part at time t | float |

| simulate_paths(n) | Public | Simulate n Short rate paths | np.ndarray |

| plot_calibrated(simul) | Public | Plot yield curve against simulate curve | None |

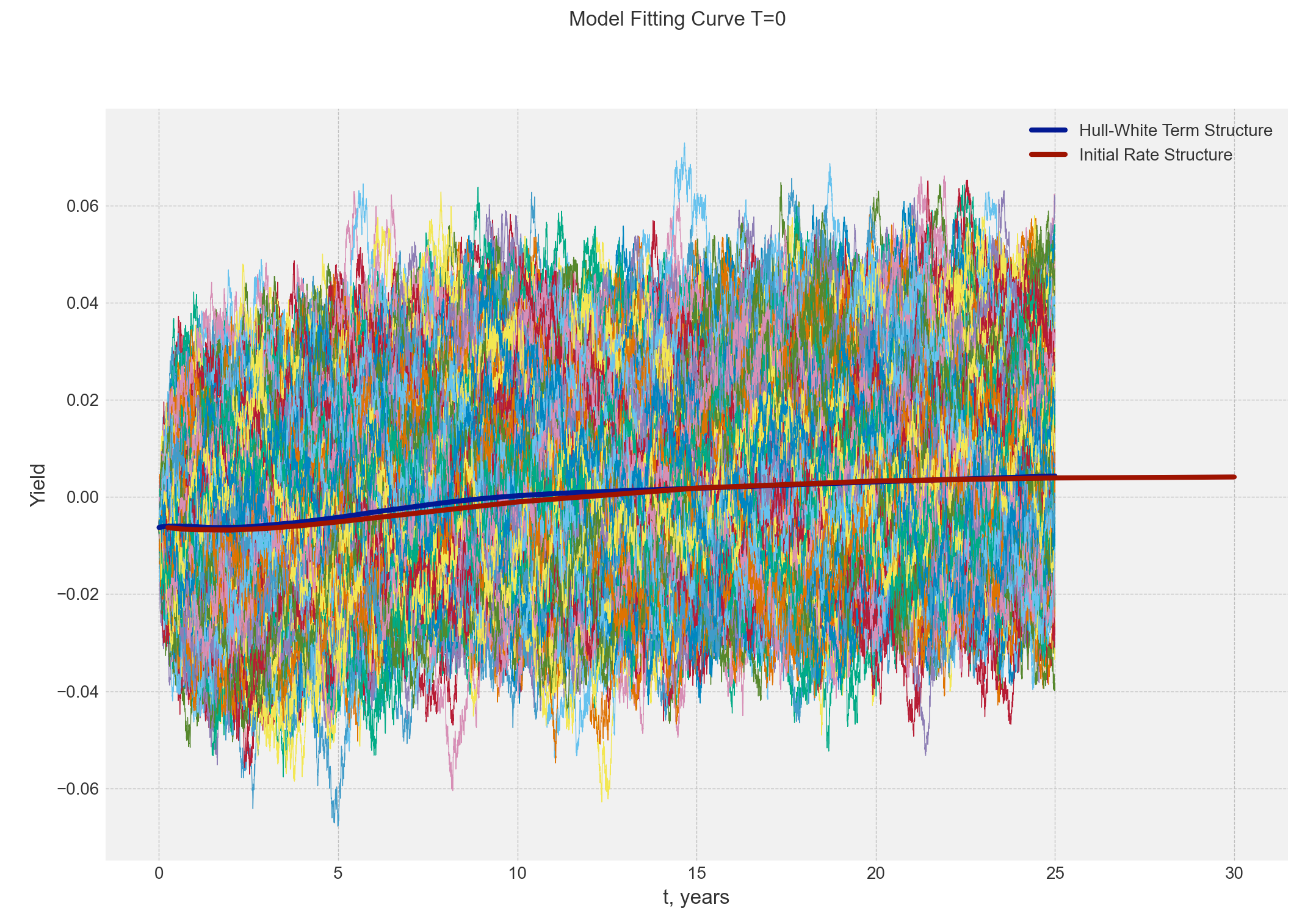

### Example

```sh

from PyCurve.bjork_christensen_augmented import BjorkChristensenAugmented

from PyCurve.hull_white import HullWhite

import numpy as np

from PyCurve.curve import Curve

# Instance of curve : Spot Rates

time = np.array([0.25, 0.5, 0.75, 1., 2.,

3., 4., 5., 10., 15.,

20., 25., 30.])

rate = np.array([-0.0063171, -0.00650322, -0.00664493, -0.00674608, -0.00681294,

-0.00647593, -0.00587828, -0.0051251, -0.00101804, 0.00182851,

0.0032962, 0.00392117, 0.00412151])

curve = Curve(time, rate)

# Deduce Forward rate via Bjork Christensen (as example but you can directly create an instance of Curve with values)

bjc_a = BjorkChristensenAugmented(0.3, 0.4, 12, 12, 12, 1)

bjc_a.calibrate(curve)

forward_curve = [-0.006301821217413436379]

forward_curve_t = [0]

for i in range(12):

forward_curve.append(bjc_a.forward_rate(time[i], time[i + 1]))

forward_curve_t.append(time[i])

instantaneous_forward = Curve(forward_curve_t, forward_curve)

# Hull and white model with High Volatility

hull_white_model = HullWhite(1, 0.02, -0.0063, 25, 1 / 365, instantaneous_forward, 'linear')

simulation = hull_white_model.simulate_paths(1000)

hull_white_model.plot_calibrated(simulation,curve)

```

```yaml

Bjork & Christensen Augmented Model

============================

beta0 = 0.0003242320890548229

beta1 = 0.00042283628067360974

beta2 = 0.014729859086888815

beta3 = -0.03083749691652102

beta4 = -0.020626731632810553

tau = 1.137911384276111

____________________________

============================

Calibration Results

============================

CONVERGENCE: REL_REDUCTION_OF_F_<=_FACTR*EPSMCH

Mean Squared Error 3.084012924460394e-06

Number of Iterations 24

____________________________

```

All the tools for graphing from simulation could be applied to Hull-White simulation results.

```sh

# Hull and white model with High Volatility

hull_white_model_low_vol = HullWhite(1, 0.00002, -0.0063, 25, 1 / 365, instantaneous_forward, 'cubic')

simulation = hull_white_model_low_vol.simulate_paths(1000)

simulation.plot_model()

hull_white_model_low_vol.plot_calibrated(simulation,curve)

```